Encourage Your Employees to Do an Annual ‘Paycheck Checkup’

March 1, 2019

As the first federal tax returns for 2018 are starting to be filed by the early birds, many are unpleasantly surprised by their lack of refund this year. Why the surprise? Most people didn’t notice their paycheck in 2018 grew slightly based on the reduced withholding requirements set forth by the Tax Cuts and Jobs Act.

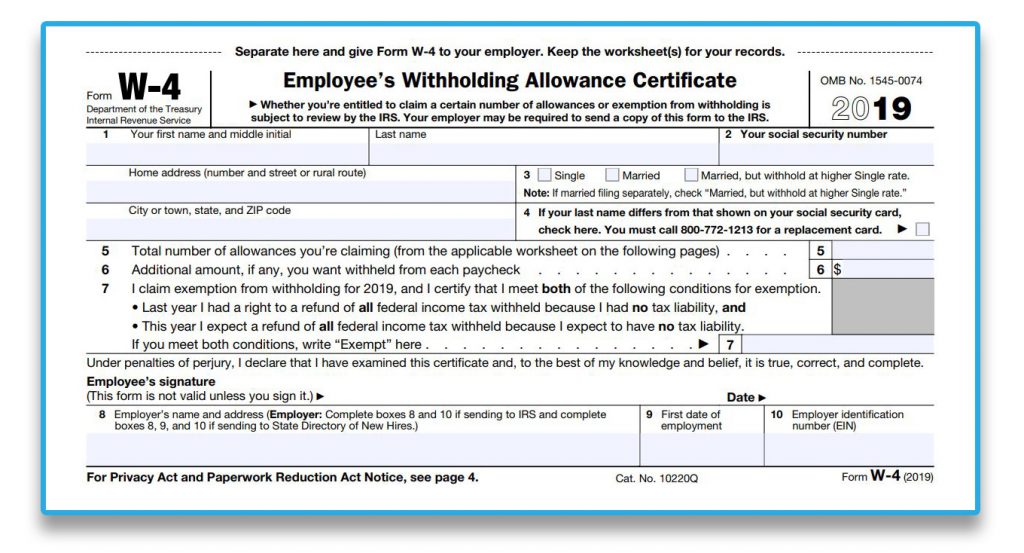

You can help your employees avoid unwanted surprises by encouraging them to do a ‘paycheck checkup’ every year. Best suited to take place in the first quarter of year, an employee’s review of their withholdings for the current year can help them determine if they need to submit a new W-4. The sooner your employees check and adjust their withholding, the better.

Simply reminding your employees to review their withholdings can be a significant help in reducing unwanted stress come tax time the following year. Guide them to tools, such as the IRS withholding calculator or the Tax Withholding and Estimated Tax publication for those with more complex tax situations, to help them determine what their withholding should be. Also, it’s a good idea to provide them with an opportunity to complete the new 2019 W-4 form in case they need to submit changes. Using DM Payroll’s self-service MyInfo portal makes this task easy for employees with online access to make changes 24/7.